Uyarı! Döviz rezervleri düştü! Devlet iflas ediyor! Bu ülkelere ihracat yapmak riskli!

Moğolistan'ın döviz rezervleri yetersiz ve bankalar ABD doları ve avro cinsinden işleri askıya alıyor! Asya Kalkınma Bankası daha önce

Asya Kalkınma Görünümü 2022

Raporda, art arda üç çeyrek negatif büyüme nedeniyle Moğolistan ekonomisinin bir kriz durumuna düştüğünü belirtti. Raporda, yeni taç salgınına ek olarak, jeopolitik çalkantıların neden olduğu yeni risk ve sonuçların Moğolistan da dahil olmak üzere dünyanın dört bir yanındaki ülkelerin ekonomilerini ciddi şekilde etkilediğine dikkat çekildi. Salgından etkilenen Moğolistan'ın sınır limanları geçmişte uzun süre kapalı veya yarı kapalıydı, mineral ürünler gibi büyük ihracat ticareti ciddi şekilde engellendi, emtia arzı yetersiz kaldı, döviz gelirleri büyük ölçüde azaldı. , ve tugrik döviz kuru düşmeye devam etti. , enflasyon keskin bir şekilde yükseldi ve bu durum devam ediyor.

Moğolistan'daki döviz rezervlerinin yetersizliği ve tugrik'in sürekli değer kaybetmesi, ülkedeki çeşitli ticari bankaların USD, EUR ve RMB gibi büyük uluslararası para birimlerinde müşteriler için nakit çekme işini arka arkaya askıya almasına ve müşterilerin yalnızca küçük para birimleriyle işlem yapmasına izin vermesine neden oldu. döviz transferleri.

Yerel kamuoyu, Moğolistan'ın ihracat gelirindeki düşüşün, son zamanlarda ülkenin döviz piyasasında nakit sıkıntısına yol açtığına ve Moğolistan'daki ticari bankaların, Moğolistan'daki ticari bankaların para kazanmasının ana nedenleri olan işletmeler ve bireylerden gelen döviz talebindeki artışla birleştiğine inanıyor. döviz nakit çekimlerini askıya almak için art arda alınan önlemler. sebep.

The delay in the recovery of the $6 billion bailout fund from the International Monetary Fund has also led to a sharp drop in the country's foreign exchange reserves. It is reported that Pakistan currently needs at least 15 billion US dollars to stabilize foreign exchange reserves and strengthen the rupee. Pakistan has reached an agreement with the International Monetary Fund (IMF) in the latest negotiations that Pakistan will increase fuel prices by 20% to obtain aid funds allocated by the IMF.

According to CCTV news, on June 2, local time, Moody's, an international credit rating agency, lowered Pakistan's credit rating outlook from stable to negative, and affirmed Pakistan's long-term foreign and local currency issuers and senior unsecured debt ratings to B3. In a statement released by Moody's, Pakistan's external vulnerability risks have been amplified by rising inflation, which is putting downward pressure on the current account, currency and already meager foreign reserves.

In addition, in order to stabilize the economy, Pakistan's Minister of Information Aurangzeb announced that the country's government has decided to ban the import of luxury goods and all non-essential items. It explained that Pakistan's current focus is on exports, and the government will reduce its reliance on imports. The prohibited goods mainly include:

Automobiles, mobile phones, household appliances, fruit and dried fruit (except Afghanistan), pottery, personal weapons and ammunition, shoes, lighting equipment (except energy-saving equipment), headphones and speakers, sauces, doors and windows, travel bags and suitcases, sanitary ware, Fish and Frozen Fish, Carpets (except Afghanistan), Preserved Fruit, Tissue Paper, Furniture, Shampoo, Candy, Luxury Mattresses and Sleeping Bags, Jams and Jelly, Corn Flakes, Cosmetics, Heaters and Blowers, Sunglasses, Kitchen Appliances, Soft Drinks, Freezers Meat, juice, ice cream, cigarettes, shaving supplies, luxury leather clothing, musical instruments, hair dryers, chocolates and more.

The Lebanese government goes bankrupt and the economic crisis continues! In recent years, Lebanon's economy has remained sluggish, with high public debt and high unemployment. The new crown epidemic and the explosion at the Beirut port in August 2020 have made the Lebanese economy even worse.

At the beginning of 2022, Lebanon's economic situation improved for a time, but because the country's economy is very dependent on imports, since the outbreak of the Russian-Ukrainian conflict, Lebanon's transportation lines for purchasing various materials in the past cannot continue to pass through the Black Sea. , Lebanon's domestic prices have risen sharply. In early April, Lebanese Deputy Prime Minister Saad Shami announced that the Lebanese central bank and government had been in bankruptcy.

Recently, a report said that after months of relative calm, the Lebanese pound has fallen to an all-time low of 35,600 per dollar. The currency's latest decline is expected to exacerbate Lebanon's economic challenges. Since more than 80% of Lebanon's domestic commodities are imported, the depreciation of the local currency has caused the prices of imported commodities to skyrocket, and important materials such as fuel and medicines are in serious shortage.

For Lebanon's current socio-economic situation, coupled with the current global epidemic background, the tourism industry, which is Lebanon's main source of foreign exchange income, will be further affected. The production and business activities of some buyers are affected by the social unrest in the country and the shortage of domestic dollars, resulting in payment arrears.

It is expected that business risks will further increase as the multiple political and economic situations in Lebanon continue to deteriorate. Especially in the current situation where Lebanon's exchange rate has plummeted, the local currency has depreciated, and the economy is facing high risks, importers are likely to use this loophole to damage the interests of suppliers due to cost pressures. Risk control, beware of risks such as abandonment of goods and non-payment by buyers at the destination port, so as to avoid loss of money and goods.

Sri Lanka is in a serious economic crisis, or will become the first emerging market country to experience thunderstorms! Sri Lanka is facing its worst economic crisis since independence in 1948, defaulting on its sovereign debt for the first time, shrinking foreign exchange reserves to the verge of bankruptcy, shortages of daily necessities and even medicines, and occasional power outages, triggering anti-government demonstrations that have lasted for more than a month, prompting Mahinda Rajapaksa ( Mahinda Rajapaksa resigned as prime minister, but the root causes of the demonstrations remain unresolved.

Sri Lanka, located on the south coast of India, is an economy with a GDP of $81 billion. According to data from the Sri Lanka Statistics Department, Sri Lanka's inflation rate in May has reached an astonishing 39.1%, breaking the record of 29.8% in April, of which the food inflation rate has risen to 57.4%. The island nation is in the midst of the worst recession in its independence history as inflation and a sharp depreciation of its currency and the economic crisis have left the country short of the hard dollar currency it needs to import food and fuel. Many factories and businesses are unable to operate at all, and the country's economy has suffered huge losses.

Since the terrorist attack in Sri Lanka in April 2019, the income of the country's tourism industry has begun to decline, and the situation has worsened since the outbreak of the epidemic. This year, the energy prices caused by the crisis in Russia and Ukraine have soared and the yields of US dollars and US bonds have risen simultaneously. Put Sri Lanka on the ground and become the first emerging market country to experience thunderstorms.

The country previously said it would temporarily suspend all foreign debt repayments due to dwindling foreign reserves due to the economic and balance of payments crisis.

Sri Lanka is a country with a relatively weak industrial base, mainly focusing on agriculture, tourism and light industries of clothing and textiles. At present, due to the impact of external debt pressure and inflation, Sri Lanka's budget deficit has expanded to 12.2% of GDP. Sri Lanka currently has $51 billion in debt, but its available foreign exchange reserves are only around $25 million.

In addition, the Sri Lankan government announced on the 31st that the tax increase, including the value-added tax from 8% to 12%, will take effect immediately and is expected to increase government revenue by 65 billion Sri Lankan rupees; from October, the corporate income tax will also be raised from 24% to 30% , is expected to add 52 billion Sri Lanka rupees to the national coffers.

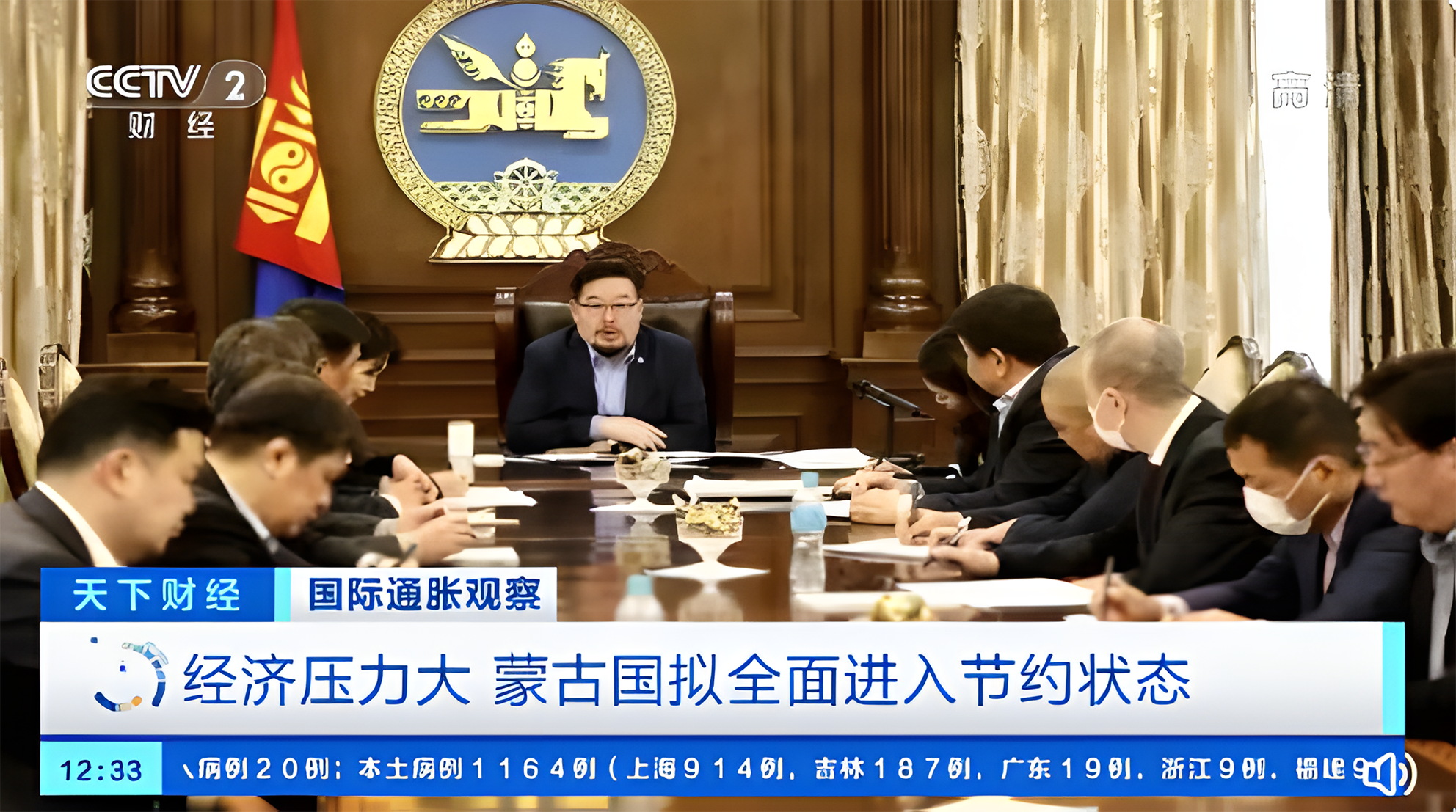

Mongolia's foreign exchange reserves are in short supply, and banks suspend business in US dollars and euros! Earlier, the Asian Development Bank released the "Asian Development Outlook 2022" report, stating that due to three consecutive quarters of negative growth, Mongolia's economy is falling into a state of crisis. The report pointed out that in addition to the new crown epidemic, the new risks and consequences caused by geopolitical turmoil have severely impacted the economies of countries around the world, including Mongolia. Affected by the epidemic, Mongolia's border ports have been closed or semi-closed for a long time in the past, major export trade such as mineral products has been severely hindered, commodity supply has been in short supply, foreign exchange income has been greatly reduced, and the tugrik exchange rate has continued to decline. , inflation has risen sharply, and this situation is still continuing.

The shortage of foreign exchange reserves in Mongolia and the continuous depreciation of tugrik have caused various commercial banks in the country to successively suspend the cash withdrawal business for customers in major international currencies such as USD, EUR and RMB, and only allow customers to handle small foreign exchange transfers.

Local public opinion believes that the decrease in Mongolia's export revenue has led to a shortage of cash in the country's foreign exchange market recently, coupled with the surge in foreign exchange demand from enterprises and individuals, which are the main reasons why commercial banks in Mongolia have successively adopted measures to suspend foreign currency cash withdrawals. reason.